A platform that encourages healthy conversation, spiritual support, growth and fellowship

NOLACatholic Parenting Podcast

A natural progression of our weekly column in the Clarion Herald and blog

The best in Catholic news and inspiration - wherever you are!

Donelon: Flood insurance to rise, but still your best bet

-

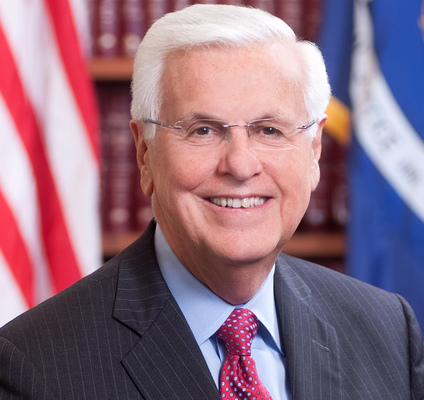

Louisiana Insurance Commissioner Jim Donelon tells the Clarion Herald there are several things all policyholders should be aware of during the 2021 hurricane season.

Q: Almost a year after Hurricane Laura devastated Lake Charles, prices are rising for housing materials, which are in short supply, and for contractors, which means homeowners may be underinsured for the value of their losses. Where does that devastated area stand right now?

Q: Almost a year after Hurricane Laura devastated Lake Charles, prices are rising for housing materials, which are in short supply, and for contractors, which means homeowners may be underinsured for the value of their losses. Where does that devastated area stand right now?A: That was a widespread problem (in 2005) in the aftermath of Katrina and Rita, throughout the state, because, frankly, the (insurance) companies had been derelict in their duty to protect themselves by adjusting upward the insured value of properties that they had on their books. The policyholder thinks that’s a benefit, and to the extent that they avoid catastrophes, fires or hurricane wind damage, it is a benefit because premiums are lower. But when you have a total loss, as many did with flat roofs during Katrina and Laura, you really need to have an accurate insured value on your home in order to replace it. There’s been a 150 to 200% increase in the cost of lumber just in the past 90 days nationwide. I don’t know the reason for it, but it’s pervasive and it’s nationwide. The Lake Charles area is straining under a capacity challenge relative to accessing creditable, responsible contractors. That will be the case probably for another six months.

Is there much difference in how Lake Charles is recovering – in terms of the availability of people to help fix the houses and the availability of supplies – and what happened after Katrina?

It’s very similar. Memories are short, and people forget. I don’t forget. I was working in the middle of it when it all took place. There were a million claims filed for Katrina and Rita. We’ve had 310,000 filed for Laura, Delta and Zeta combined from last year. Clearly, it was our second-worst year ever, and Laura is our second-worst insured loss event ever, by a lot. It’s twice what insurers paid for Rita damage – $3.3 billion vs. $8.4 billion. But still, the Big Kahuna for wind damage – not counting flood – is Katrina, when we collected $23.3 billion for insured losses.

You always stressed how important it is for Louisiana homeowners to purchase flood insurance. Does it look like flood insurance is going to be more expensive going forward?

They’re calling it “Risk Rating 2.0.” It was proposed by FEMA during the Trump administration and was put on hold for a year as the election neared. Frankly, I would not be surprised to see that happen again, and it does come with significant rate increases for thousands, if not tens of thousands, of policyholders in our state. We don’t know the details. We know the concept. The overall aim of this new method of pricing flood insurance policies is to make the program self-sufficient. That was attempted in the last long-term reauthorization (seven years ago), which until the last two times has taken place every five years since the program was put in place after Betsy hit New Orleans in 1965. Virtually all the insurers said after that event that they were going to exclude flood (damage) from their property insurance policies, both commercial and residential. So the federal government stepped in to provide coverage for that flood exposure and reauthorized it each time in five-year increments until 12 years ago. At the end of that expiration, they kept kicking the can down the road until finally the Biggert-Waters Flood Insurance Reform Act was passed as a compromise between the fiscal hawks who wanted to put the program on a five-year glide path to actuarial rates and those in coastal areas, like ourselves. By the way, we got unanticipated help from superstorm Sandy, which brought Democrats and Republicans to our side of this issue in the reauthorization battle. But even with their help, because of the five-year glide path (to actuarial rates), the Biggert-Waters reauthorization would have rendered tens of thousands of properties in our state worthless overnight because they couldn’t afford the flood insurance premiums. And without flood insurance, you can’t get financing. Without financing, there’s no market for such properties. I handed (President Obama) a letter that GNO, Inc., had put together asking him to support the effort to roll back the draconian rate increases that Biggert-Waters called for. He had expressed support for the Biggert-Waters’ goal of reaching actuarial rates over a five-year period but ultimately signed off on the roll back, which put in place an 18% per year cap on rate increases. Now, we will see a sunset (of the extension) in September if it’s not reauthorized beyond that – hopefully for another five years. But when that happens, based on “Risk Rating 2.0,” I am pretty confident it will propose significant rate increases for thousands of policies in our state. So, if people are not insured for flood now, if they would get a policy, they would probably be grandfathered in with their current status and not have to pay new policy prices under Risk Rating 2.0 and be at least protected for the transition period that I anticipate will be part of Risk Rating 2.0.

Is the thinking that it could be an 18% increase a year over the next several years to get to the actuarial rates?

That’s correct. That’s in the proposal now. But know that the people who are proposing long-term extensions, like our congressional delegation and delegations from New Jersey, New York, etc., are proposing much lower than 18% caps for the long-term extension. Generally speaking, that’s in the 9% range.

Do you get antsy when June 1 rolls around each year?

Absolutely. We’re in the center of the cone of so many projected paths for hurricane events. I start counting down the days from June 1 to Nov. 30. Frankly, I used to count them down to Oct. 1; now, I count them down to Nov. 1, because after November, generally, the atmosphere and the water is cooling down somewhat to not be such an incubator for our storm events.

Any other advice?

The most important thing is for people to access the National Flood Insurance Program, which benefits us more than any other state – but only 25% of the residences in Louisiana are insured for flood. I tell folks it’s the best insurance any property owner in any part of our state can make. The second-biggest message is to get with your agent and know what your coverages are, because with every event, there’s shock and amazement at what’s called the “named storm” wind and hail deductible. That deductible is a percentage not of your loss but a percentage of your insured value. If you have a home that’s insured for $450,000 and you have a 2% “named storm” deductible, that’s $9,000 before your insurance kicks in to cover hail damage or a hurricane. Although in the aftermath of Katrina, the Legislature in a special session required that the (“named storm” deductible) be put on a separate line of your policy in larger print with the calculation of what it is, still, the majority of people are unaware that that is in place, even now, 15 years after Katrina.